As expected, and despite opposition, the Fair Trading Amendment Bill (Bill) passed its third and final reading yesterday and is currently awaiting Royal Assent. The Bill will amend the Fair Trading Act 1986 (FTA), with the most significant changes coming into force in approximately a year's time.

New Zealand businesses should begin preparing for these changes, which include an extension of the FTA's unfair contract term (UCT) regime to "small trade contracts" – a new prohibition on unconscionable conduct in trade and amendments to the uninvited direct sales provisions. For further information on the key amendments, please see here.

Reviewing possible UCTs

Our experience when the initial business-to-consumer (B2C) UCT regime came into force was that businesses who had proactively reviewed relevant contracts and made changes were best placed to avoid complaints and scrutiny from the Commerce Commission (NZCC). This includes making judgement calls on whether to retain terms that could be deemed unfair, even if they offer commercial benefits.

The same approach should be taken where businesses use standard form contracts in business-to-business (B2B) small trade contracts. We recommend reviewing the terms contained in these contracts to assess whether they are at risk of being said to amount to UCTs.

What is a "small trade contract"?

Under the Bill, a small trade contract is a standard form contract where the parties are engaged in trade; is not a consumer contract; and does not comprise or form part of a trading relationship that exceeds an annual $250,000 value threshold when the relationship first arises.

How is an unfair contract term (UCT) determined?

A term will be considered "unfair" where the term (cumulatively):

-

would cause a significant imbalance in the parties rights and obligations arising under the contract;

-

would cause detriment (whether financial or otherwise) to a party if it were applied, enforced or relied on – case law indicates this is a low threshold; and

-

is not reasonably necessary in order to protect the legitimate interest of the party who would be advantaged by the term.

A term cannot be applied, enforced, or relied upon only once the High Court has declared that the term is unfair following an application from the NZCC. This means that until a term is declared unfair it can continue to be relied on and enforced.

While that is useful for contractual certainty in advance of any such declaration, businesses need to be alive to the risk of negative publicity or reputational damage from an investigation into possible UCTs or proceedings, as well as the risk that following a declaration, all such terms will be unenforceable (they simply become unenforceable, they are not "read-down" to something that is considered fair). Therefore, businesses should carefully weigh these risks in deciding whether to proactively review their standard form contracts now.

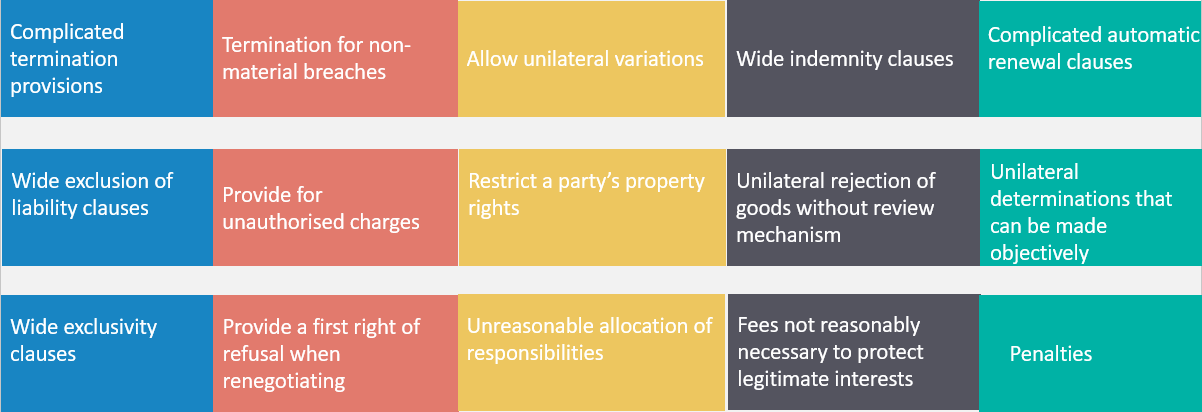

Under the UCT regime and the Australian experience, certain types of terms that are at greater risk of being regarded as UCTs, for example:

Practical tips for reviewing standard form B2B small trade contracts

While each term will have to be considered on a case by case basis, we recommend that businesses keep in mind the following practical tips when reviewing standard form B2B small trade contracts:

-

Terms should be transparent, in "reasonably plain language", legible, presented clearly, and readily available to any party affected by them.

-

Terms should always be justifiable and be reasonably necessary to protect the legitimate interests of the business seeking to enforce them.

-

Penalties will usually amount to unfair terms.

-

Aim for mutuality in the nature and effect of terms, in particular for indemnity, liability and termination provisions.

-

Consider who can control certain matters. If a party has a one-sided obligation imposed upon them where they have less control of the matter (for example if a party is required to indemnify the other party for losses that they have not caused or pay a fee in circumstances beyond their control) this may be deemed unfair.

-

Limiting or excluding liability to the maximum extent possible or beyond what is reasonably necessary to protect the interests of a party may be deemed unfair.

-

Document the reasons for each potentially unfair term (ideally in a communication protected by legal privilege).

-

If there is a real risk that a term may be unfair, the term should be drafted separately from other terms in the contract. This is important because the Court cannot sever an unfair requirement from the remainder of the term to reserve its operation. Therefore, fair requirements included in an unfair contract term provision, are also unenforceable.

We will be publishing separate Alerts dealing with the challenging issues that arise under the impending unconscionability provisions.

If you have any questions regarding the changes that will be bought into effect by the Bill, or how they will relate to your business, please contact one of our experts below.