Yesterday, the Reserve Bank published its high-level decisions resulting from the 2025 review of key capital settings. In this insight, we summarise the final policy outcomes. In our earlier insight, we set out the background to the review and the options that the Reserve Bank consulted on.

Key decisions

The Reserve Bank has confirmed that:

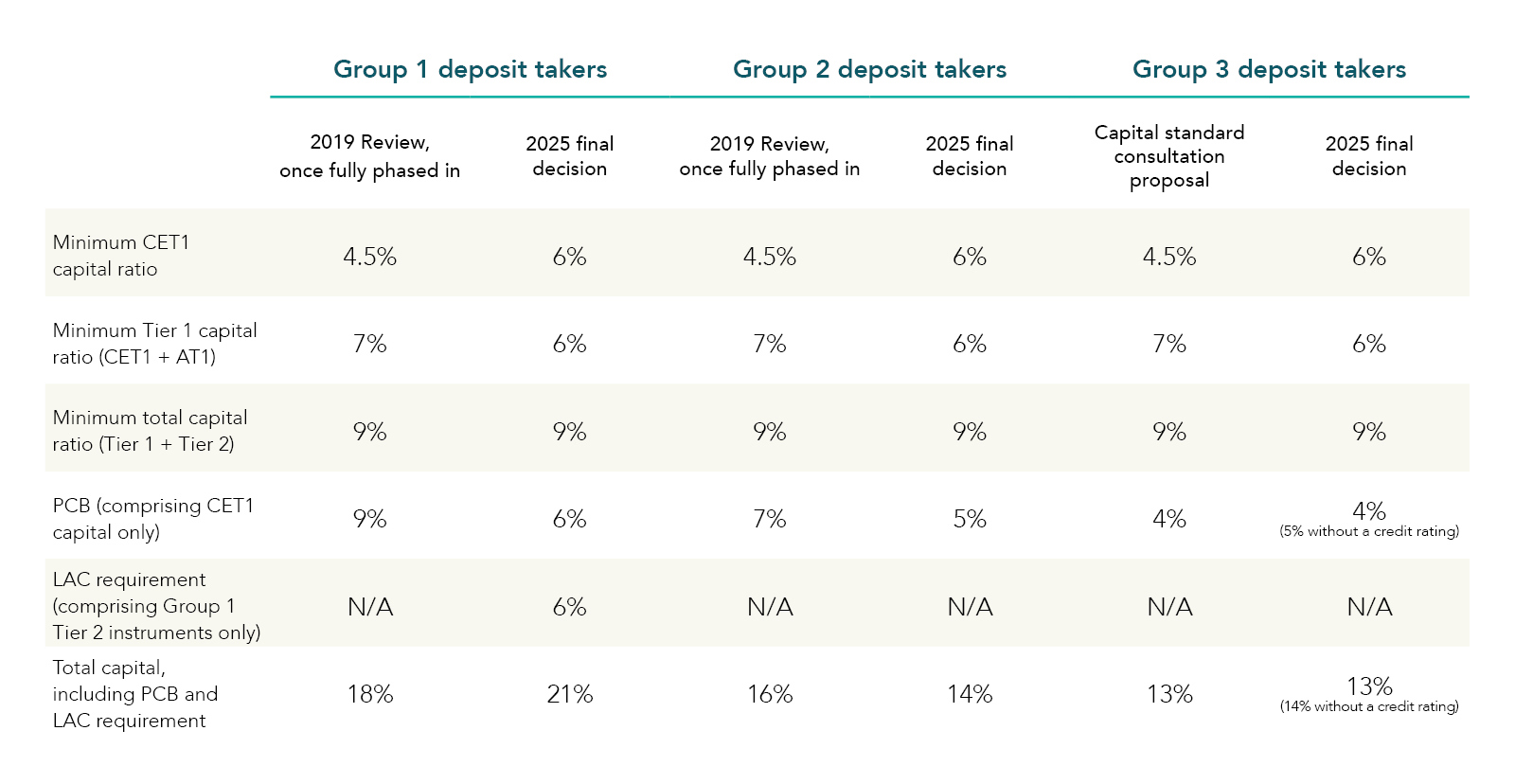

- Changes to the regulatory capital stack: Minimum common equity tier 1 (CET1) capital requirements will change for all groups of deposit takers relative to the final 2028 settings under the 2019 capital review (2019 Review).

- Group 1 deposit takers: The Reserve Bank has opted for Option 2 for Group 1 deposit takers (ie the four large Australian-owned banks). Under Option 2, Group 1 deposit takers will be required to hold less going-concern CET1 capital (ie ordinary shares, retained earnings etc) after taking into account the prudential capital buffer (PCB) than under the 2019 Review decisions (once fully implemented) but will be required to issue more gone-concern Tier 2 capital and loss-absorbing capacity (LAC) instruments with write-down and conversion features to their Australian parent banks.

- Group 2 and Group 3 deposit takers: There has been no change to the regulatory capital stack for Group 2 and Group 3 deposit takers from the options that were consulted on. The Reserve Bank indicated that any further reductions to the minimum capital requirements would risk the soundness and safety of Group 2 and Group 3 deposit takers, which it expects to benefit proportionally more from the reductions to standardised risk weights.

- Removal of Additional Tier 1 capital: Additional Tier 1 (AT1) capital will be phased out of the regulatory capital stack for Group 1 and Group 2 deposit takers. For Group 3 deposit takers (several of which rely on perpetual preference shares for their capital requirements) perpetual preference shares will gradually transition from qualifying as Tier 1 capital to Tier 2 capital.

- More granular standardised risk weights: The Reserve Bank will introduce more granular standardised risk weights for residential mortgage, corporate, agricultural and community housing provider lending to more accurately reflect the credit risk associated with these lending categories. In response to feedback received on the consultation paper, the Reserve Bank has made some technical refinements to the options that were consulted on. The Reserve Bank has indicated that it will also consider submissions on introducing a range of new standardised risk weight categories, including for infrastructure lending and securitisation exposures. There will be no changes to the internal ratings-based (IRB) approach to calculating risk weighted assets for IRB-accredited banks (ie no change to the scalar or standardised floor). The Reserve Bank has also left open the possibility of introducing a leverage ratio in the future.

Loss-absorbing capacity requirement

The new LAC requirement will apply to Group 1 deposit takers only. LAC and Tier 2 capital will be made up of the same types of instruments. The LAC requirement is in addition to the minimum total capital ratio requirement (which may include Tier 2 capital). The Reserve Bank will consult on the specific design features of the Tier 2 and LAC instruments in future consultations, but has confirmed that the instruments will be required to contain mandatory write-down and conversion features. These features are designed to recapitalise a deposit taker experiencing financial distress. The instruments will be required to be issued internally, rather than to external investors. The Reserve Bank expects that the features of the instruments will be broadly consistent with the Financial Stability Board's principles for "bail-in" instruments. The Reserve Bank indicated that it will work closely with APRA in developing the instruments.

In October 2024, the Reserve Bank published an issues paper on how it may operationalise its resolution powers under the Deposit Takers Act 2023 (DT Act), including whether it should introduce a "bail-in" resolution tool and, if so, the mechanism to achieve bail-in (ie contractual, structural or statutory bail-in) (see our previous insight on a potential bail-in tool). We expect the design of the Tier 2 and LAC instruments will provide some clarity on the Reserve Bank's approach to introducing a "bail-in" resolution tool. We also expect the Reserve Bank will be conscious of the Swiss Federal Administrative Court's decision that the Swiss regulator's order to write-down Credit Suisse's AT1 capital instruments lacked a contractual or statutory basis.

The Reserve Bank indicated that it will also consult on how Tier 2 and LAC requirements will apply to any future Group 1 deposit taker that is not a wholly-owned subsidiary of an Australian bank – and, therefore, may not be able to issue the instruments internally.

Group-level resolution vs standalone resolution

The Reserve Bank's decision to require Group 1 deposit takers to issue internal Tier 2 and LAC instruments to their Australian parent banks is designed to support its preferred “single point of entry” (SPE) model for recovering or resolving a Group 1 deposit taker. The SPE model involves resolving a domestic systemically important bank on a group-level rather than standalone basis.

A group-level resolution would involve the home authority (in this case, APRA) resolving the parent bank and its subsidiaries (including the New Zealand subsidiary) on a group basis. The Australian parent bank would be recapitalised (the "single point of entry"), with the New Zealand subsidiary obtaining any additional capital it requires from its Australia parent. The recapitalisation of the New Zealand subsidiary would be facilitated via the pre-positioning of Tier 2 and LAC instruments with write-down or conversion features.

In contrast, a standalone resolution would involve the Reserve Bank managing the deposit taker in a separate resolution process, which could involve the separation of the New Zealand subsidiary from its Australian parent bank.

Despite group-level resolution being the Reserve Bank's preferred approach, Group 1 deposit takers will still be subject to the outsourcing policy and open bank resolution (OBR) policy, and standalone resolution will still be an option.

Treatment of legacy AT1 and Tier 2 capital instruments

The Reserve Bank has confirmed that the recognition of AT1 instruments that have been issued by Group 1 and Group 2 deposit takers will be phased out. Unlike the approach APRA took when it decided to phase out AT1 capital instruments, the Reserve Bank has left the door open for issuers to redeem AT1 capital instruments due to a regulatory event.

The Reserve Bank indicated that it will consult on the transitional treatment of Group 1 deposit takers' existing Tier 2 capital instruments that will no longer qualify as Tier 2 capital when it consults on the design of new Tier 2 and LAC instruments. At this stage, existing Tier 2 capital instruments (ie subordinated notes without write-down or conversion features) will continue to qualify as Tier 2 capital for Group 2 and Group 3 deposit takers as the Reserve Bank considers that there are alternative resolution strategies for smaller deposit takers that do not rely on recapitalisation. However, the Reserve Bank noted that is still developing its resolution plans for Group 2 and Group 3 deposit takers and that any proposed changes to Tier 2 capital for Group 2 and Group 3 deposit takers would be subject to additional consultation.

Implementation timeline

The Reserve Bank will publish its response to submissions and detailed implementation plan in February 2026, together with background materials, such as the technical analysis papers, cost-benefit analysis and recommendations to the Reserve Bank board that underpin the final decisions. The Reserve Bank will consult early next year on the changes to the banking prudential requirements and non-bank deposit taker regulations to give effect to the decisions. The decisions will then be drafted into a capital standard and/or bail-in standard, which will implement the rules once the DT Act comes into force in 2028. An exposure draft of the capital standard is expected to be released for consultation in June 2026, together with a consultation on a new crisis preparedness standard.

If you would like to discuss the capital review decisions, or the implementation of the DT Act more generally, please get in touch with one of our experts.